June 16, 2023

JDRF’s 2022 Fiscal Year (FY) results show an organization operating much as it did pre-COVID. The extreme variations in expense allocation and revenue solicitation that occurred during COVID are no longer apparent in FY22. Special fundraising has largely returned to in-person, in-person meetings recommenced, and staff are starting to return to work.

In this review we will use FY 2019 as the ‘pre-COVID’ benchmark. All data used in the report, unless otherwise stated, is sourced from public financial records which are attached as endnote links.

There are four key highlights:

- Payroll and related expenses remain much lower than FY2019. Many of the personnel and structure cuts that occurred during COVID have been maintained in FY22. If JDRF leaders can resist the natural momentum to add to their workforce, the ‘savings’ can be re-invested in research grants. This would be a good thing.

- Revenue descended to its lowest level since FY12.

- Research grant spending is below FY19 by -$19 million. Research grant spending in FY22 was 36% of revenue, slightly lower than most of the prior decade, and far from the >50% levels of all years prior to 2013.

- JDRF has built up a massive war chest of dollars. $132 million sits in short-term operating investments, with about 2/3 sitting under the T1D Fund. This money can be deployed at will (we hope the majority will be used to accelerate a T1D cure).

Income: Markedly lower than prior years

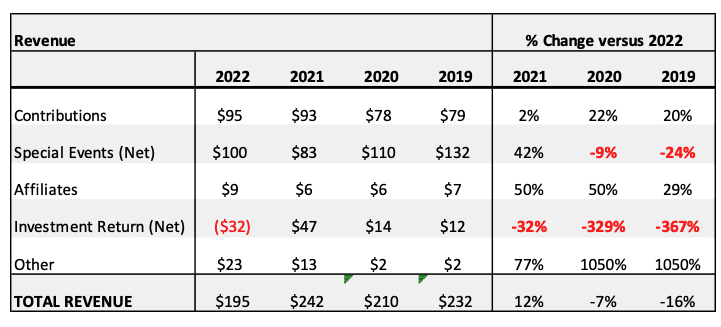

Total revenue, which combines both JDRF and the JDRF T1D Fund, reached $195 million in FY22. This was down substantially from the record $242 million collected in FY21 and down versus the $232 million of FY19 (see chart 1).

The main factor driving the revenue decline in FY22 is a lack of contribution from JDRF T1D Fund. In FY21, the Fund contributed $30 million from a capital raising campaign and an additional $27 million from investment exits. The Fund did not contribute new revenue in FY22. Going forward, we expect the Fund’s contributions to be inconsistent and sporadic.

The final revenue highlight is that in-person fundraising events have not yet fully returned to pre-pandemic levels. Special fundraising events raised $100 million in FY22 versus $132 million in FY19. We expect that this number will recover more fully in the years ahead.

Chart 1: JDRF Revenue Sources, FY 2019-2022 (in Millions)

Nominal - not adjusted for inflation

- -24% drop in revenue versus FY19 from special events, presumably due to a slower recovery than expected from in-person fundraising.

- +20% three-year gain in revenue from individual contributions

- -367% three-year decrease in revenue from investments. A loss of $32 million was taken in FY22.

Uses of Money: More Efficient Operations but Research Grants Still Below Historical Benchmarks

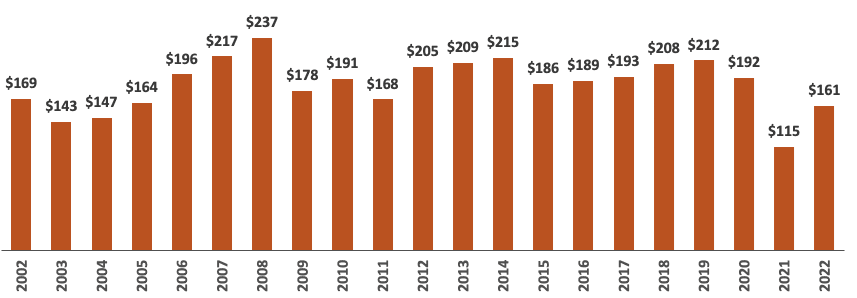

Chart 2: JDRF Total Expenses, FY 2002-2022 (in Millions)

Nominal - not adjusted for inflation

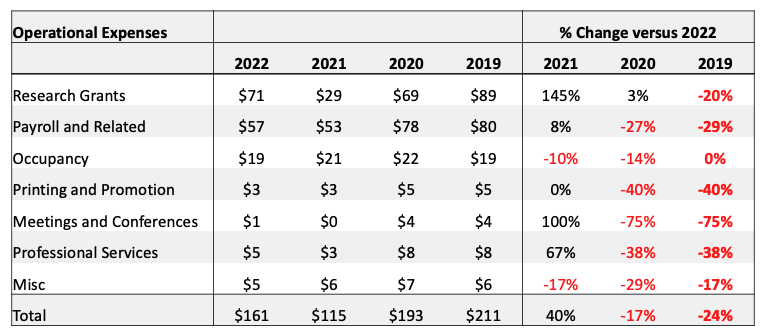

Overall, JDRF FY22 expenses are -$50 million less than the FY19 benchmark year, a 24% reduction. The two main drivers are a decrease in payroll (salaries, bonuses, etc.) and a decrease in research grants. Payroll decreased by -$23 million, a 29% reduction, while research grants decreased by $18 million, a 20% reduction (see chart 2 above).

This is a mixed story.

On the good side, the payroll cost reductions taken during COVID were carried into FY22. Payroll costs were $80 million in FY19 but were $57 million in FY22, suggesting that the JDRF is operating with greater efficiency. However, maintaining this efficiency will require board and executive discipline to resist the natural tendency of any large bureaucracy to add staff. If the efficient payroll cost structure can be maintained then the money can be reinvested into other mission-based purposes such as cure research grants, which would be of great benefit to the T1D community.

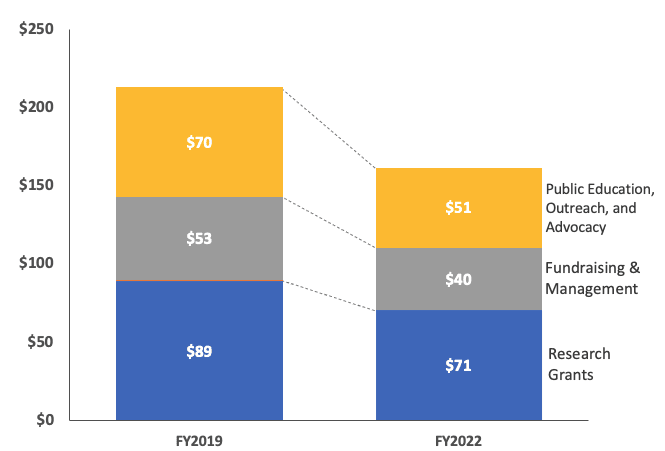

On the not-so-good side, research grant support has reduced from $89 million in FY19 to $71 million in FY22. Despite the reduction in payroll, we have not yet seen that money reinvested into research grants.

Chart 3: Program Expense FY22 versus FY19 (in Millions)

Nominal - not adjusted for inflation

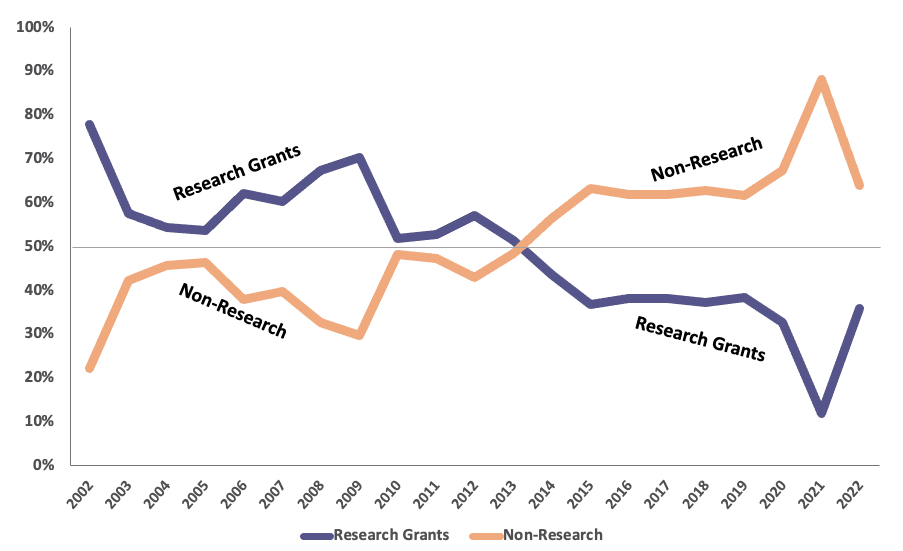

Although research grants did start to recover from COVID lows, the amounts are still much smaller than the best-practice years of the mid-2000s. In each of the benchmark years, research grants were greater than 50% of annual revenue, a trend that had remained constant until 2013 when non-research expenses surpassed research grant expenses. In the decade after 2013, non-research grants grew while grants declined (see chart 4). In FY22, nearly 2/3 of all income was used for activities other than research grants, while just a bit more than 1/3 was used for research grants.

Looking forward, JDRF leadership provided guidance via a phone discussion that research grant amounts will increase in FY23 by 40-45%. This amount of increase would mean that grants will cross the $100 million mark in FY23 for the first time since 2013.

Chart 4: Research versus Non-research as % of Revenue

A second alternative look at the operating expenses categories in Chart 5 also shows the impact of COVID in FY21 and the road to rebuilding that occurred in FY22. However, compared to FY19, all the FY22 expense categories except for occupancy (office rent) decreased.

Chart 5: Operational Expenses FY19-FY22 (in Millions)

Nominal - not adjusted for inflation

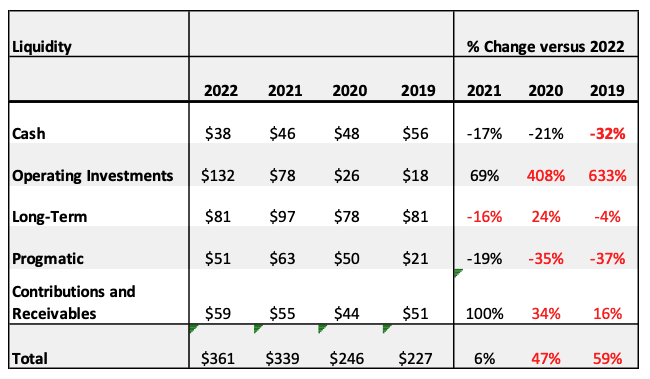

The final key point is that JDRF has built up a massive war chest of short and long-term operating investments. In FY22, $132 million was placed in short-term investments compared to $18 million in FY19, a 633% increase (see chart 6). $81 million of that money sits under the T1D Fund, waiting to be deployed for future investments, but can also be used by the parent JDRF, at its discretion. Why not use that war chest to double down on functional cure research for T1D?

Chart 6: JDRF Liquidity, FY 2019-2022 (in Millions)

Links:

JDRF International Consoldiated Financial Statements June 30, 2022 and 2021

JDRF International IRS Form 990 FY22

JDRF Fiscal Year 2022 Annual Report: Forward Together as 1