At a Glance

- JDRF released its 2023 fiscal year financials on Monday, May 6.

- Total Revenue: $224 million, +14% increase from FY22.

- Total Expenses: $213 million, +32% from FY22.

- Research grant spending: $98 million, +39% from FY22.

- Operating Investments: $188 million, +24% from FY22. This is by far the biggest cash build-up in 20 years, presenting a real opportunity to underwrite and accelerate a dedicated Practical Cure initiative.

May 9, 2024

Earlier this week, JDRF released financial statements from its most recent fiscal year (July 1, 2022 – June 30, 2023). This is the first in a series of reports reviewing JDRF’s FY23 financial statements. Below is a brief overview of JDRF’s FY23 performance with a focus on revenue, expenses, and research grants. In the weeks ahead, we will continue this series with a more comprehensive analysis.

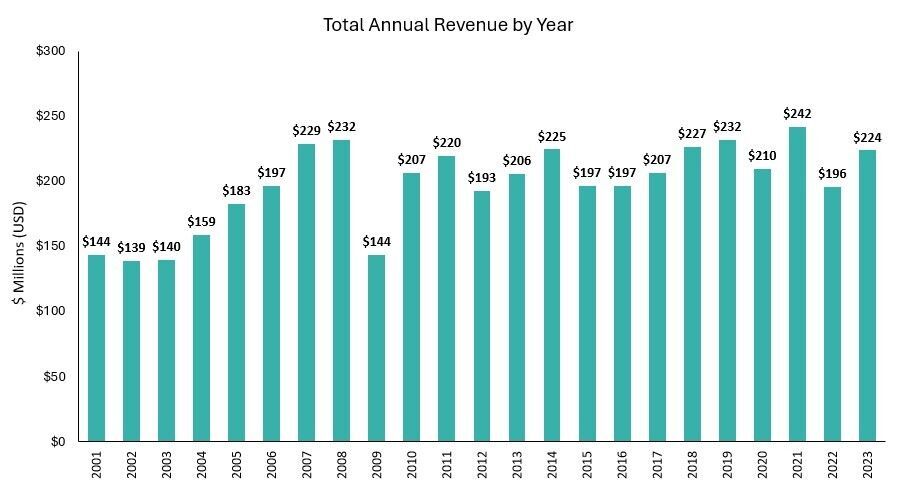

Revenue

In FY23, JDRF saw a +14% ($224 million) increase in revenue compared to FY22, in line with years prior to COVID (see Appendix A). This amount is primarily attributed to a $34 million increase in gains from JDRF’s investment portfolio.

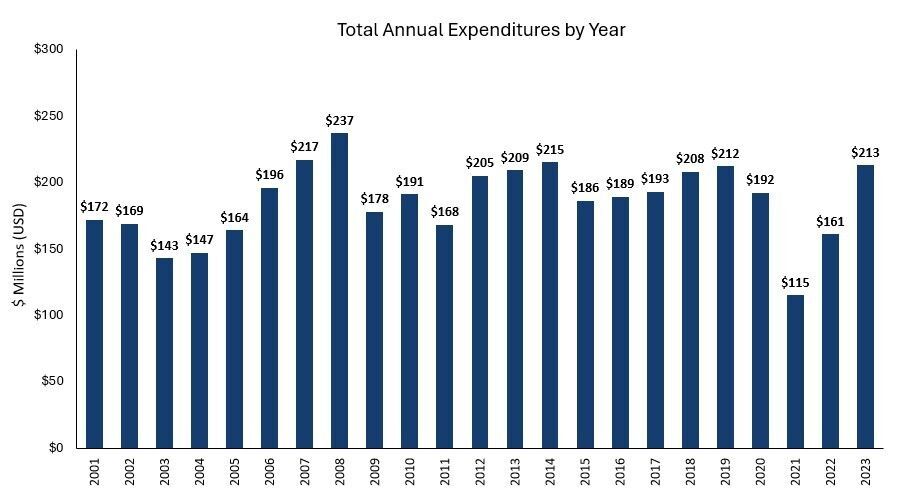

Expenses

Expenses rose by 32% in FY23 compared to FY22, a +$52 million increase in overall spending (see Appendix B). While all spending categories increased in FY23, the largest was in research grant funding, climbing from $70 million in FY22 to $98 million in FY23. Payroll increased +23%, returning to pre-COVID levels.

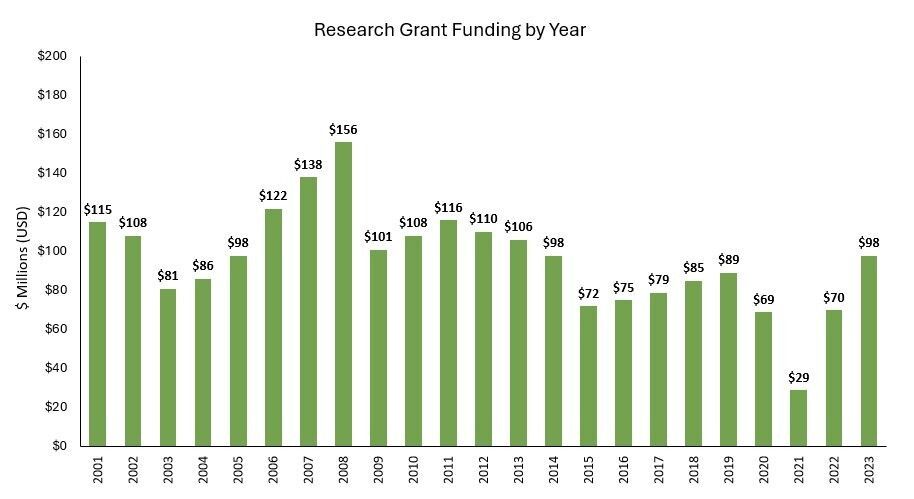

Research Grant Spending

In FY23, JDRF allocated $98 million to research grants, the highest amount since 2013 (see Appendix C). Notably, research grant spending accounted for 44% of JDRF’s total income, the largest research spending by percent of revenue in a decade. If combined with investment spending from its subsidiary T1D Fund (+$20 million), this amounts to 53% of JDRF’s annual income, the first time that JDRF has applied more than 50% of its annual income for research project funding in over a decade. Regular readers of this report are aware that JDCA has been advocating for this change for many years. We look forward to a deepening of this trend in the years ahead.

Investment Reserve

JDRF has built up a huge stockpile of readily unutilized dollars. During COVID, JDRF acted in accordance with other nonprofits by cutting expenses substantially in various areas (payroll, research and development, advertising, etc.). At the same time, donor income did not decline as expected and the T1D Fund earned a few profitable exits. This resulted in a surplus of cash, which has been invested mostly in short or medium-term vehicles.

JDRF continues to hold a large stockpile of these operating investments. In FY23, this stockpile hit a record high of $188 million, up from $18 million in 2019, the last year before COVID.

A key question that stands today is how and when this coffer of $188 million will be deployed, and which research avenue will reap the benefits. This money could do a lot of good expediting and invigorating Practical Cure research, and it would be in the T1D community’s best interests if it were used for this end.

Appendix A: Total Revenue by Year

Appendix B: Total Expenditures by Year

Appendix C: Research Grant Funding by Year